Research to help you reach your financial goals.

At Fi3 Financial Advisors, we are committed to providing timely and well-researched financial and investment guidance to our clients so that they can make more empowered financial decisions. These featured resources often are used to help guide our conversations.

March 2025 Market Review

Trumpenomics

Investors rotate certainty as President Trump seeks to reshape the economy

U.S. Equity Selloff - The S&P 500 fell -5.6% in March and -4.3% for the quarter, its worst since 2022, as stretched valuations and concentrated leadership fueled volatility.

Mag Drag - Despite 61% of securities posting returns better than the index, AI concerns and a selloff in high-valuation stocks pulled down the market. Six of the “Magnificent 7” fell between -11% to -36%, underperforming the S&P 500.

Global Rotation to Stability - Investors shifted away from U.S. equities, favoring Europe and China. MSCI EAFE out-performed the S&P 500 by 11% for the quarter, its strongest lead since Q2 2002, while China gained 15% on stronger manufacturing data and renewed policy efforts.

Growth Scare - The Federal Reserve is expected to hold rates, while fiscal policy tightens. Tepid consumer spending and declining confidence add to economic growth concerns.

Private Market Semi-Annual Update - Spring 2025

Data indicates that the capital raise downdraft is slowing and likely roughing in several asset classes; however, the number of funds closing has shrunk dramatically and the time it takes to raise capital has meaningfully increased.

Venture capital valuations have normalized with the euphoria around AI, but the space continues to face exit issues with significant value “trapped” inside of funds with limited options for liquidity.

As more capital flows into the private markets and certain parts become more efficient, investors should remain focused on areas that still benefit from structural inefficiencies.

February 2025 Market Review

Growth Scare Hits Risk Assets

High valuations come with high expectations. U.S. equity markets step back on growth concerns.

Growth Scare Hits Risk Assets - Weaker economic data, a patient Fed and shifting policy dynamics fueled slowdown fears triggering a broad selloff of U.S. equities, with defensive sectors outperforming.

Growth Puts Spotlight on Valuations - High-valuation stocks fell more than peers, while value and defensive sectors led. Consumer staples outperformed consumer discretionary by 11%, while Treasuries rallied amid shifting markets sentiment.

International Extends its Lead - EAFE took another step forward and added to its 2025 lead over S&P 500, led by EU financial and defense spending along with coding of U.S. high valuation stocks.

March 2025 Crypto Market Review

Does your portfolio need Crypto? Bob Schaefer provides thoughts on the rapidly evolving crypto markets.

January 2025 Market Review

Change in Leadership

January marks political and market shifts in leadership

Markets Adapt to Policy Shifts – President Trump’s executive orders kept investors on edge, but his position on tariffs provided a tailwind for international markets.

NVIDIA’s Wake-Up Call – A 17% drop in NVIDIA shares, triggered by AI competition from China, highlights the risks of market concentration and stocks priced for perfection.

The Fed Holds Steady – With solid GDP growth and low unemployment, the Fed left rates unchanged, signaling caution rather than a rush to ease policy.

Tariffs are an Inflation Wild Card – While tariffs could push prices higher, history also shows they are just one piece of a larger economic puzzle.

2025 Outlook & Capital Market Assumptions

Our 2025 Outlook & Capital Market Assumptions cover our investment themes for 2025 & ramifications for investor’s portfolios.

Private Market Semi-Annual Update

• Following two years of waning deal activity, the first half of 2024 has seen a promising rebound, with a year-over-year increase of 12%.1 Corporate carveouts and smaller add-on transactions remained particularly attractive to General Partners.

• The median fundraising timeline has stretched beyond 18 months, largely due to a shortage of distributions affecting Limited Partners’ capacity to commit to new funds.1 Nevertheless, high-conviction and appropriately sized funds continued to be oversubscribed, achieving rapid closings.

• Exit activity remained a significant challenge, with capital calls outpacing distributions for the third consecutive year. The emergence of continuation funds as a popular exit strategy reflects the industry’s adaptation to this dynamic. In addition, there has been discussion swirling at the largest end of the market as some companies may start to become ‘too big to exit’.

• There is a divergence in performance between mega funds and middle-market funds, the latter of which posted more compelling returns. This trend underscores the potential advantages of investing in the lower and middle market where funds often benefit from less leverage, greater operational agility and a broader range of exit options.

2023 Review & 2024 Outlook Video

Listen to Bob Schaefer, Senior Director of Investments, talk about the review of the 2023 market and what 2024 currently looks like.

2023 Portfolio Rebalancing

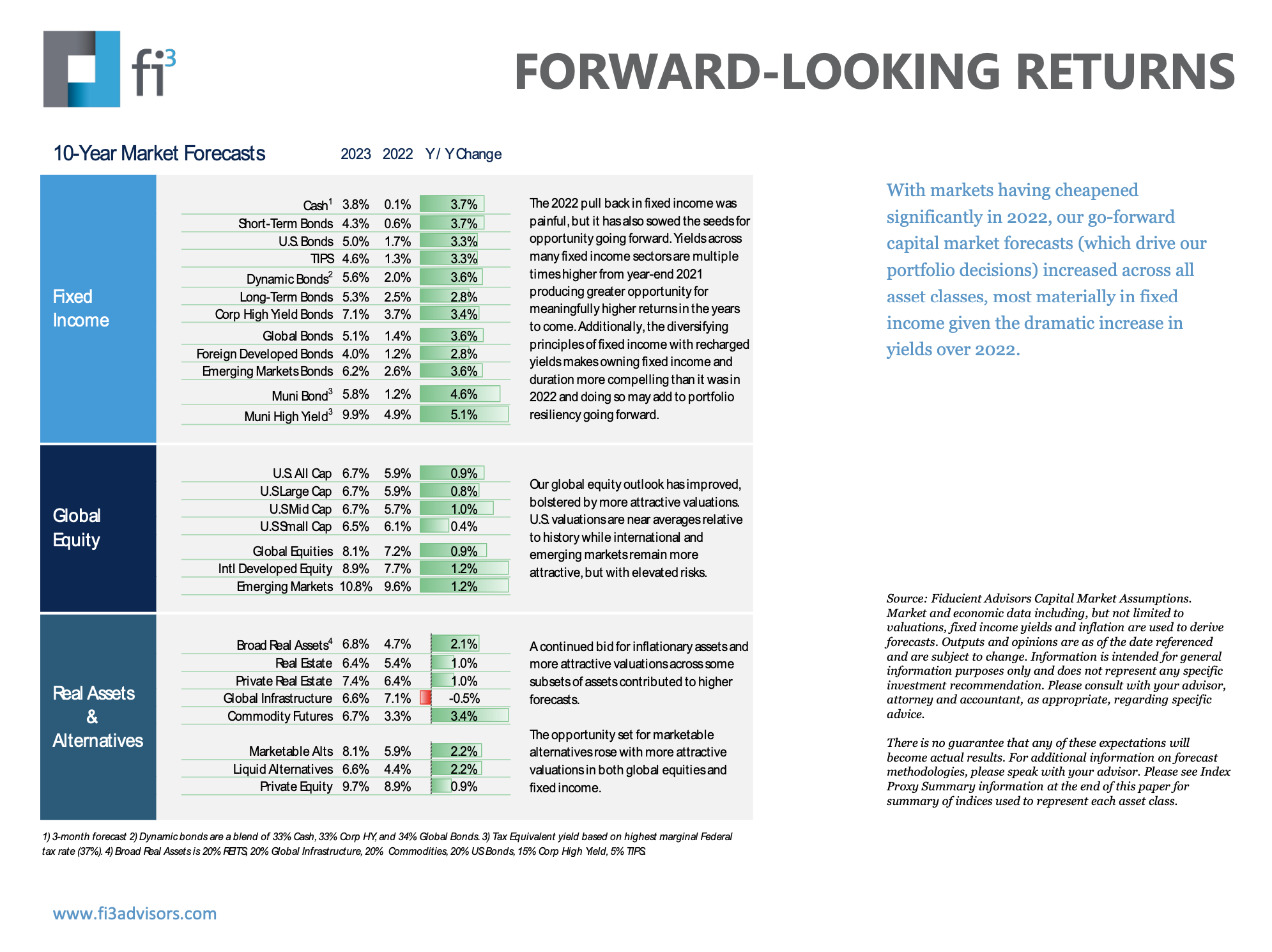

With markets having cheapened significantly in 2022, Fi3's go-forward capital market forecasts (which drive our portfolio decisions) increased across all asset classes, most materially in fixed income given the dramatic increase in yields over 2022.

2023 Market Outlook

Opportunity is forecasted to grow in 2023, even with the continued uncertainty the markets have experienced in recent years. With capital marketing forecasts increasing across all asset classes (most materially in fixed income,) our outlook features three key investment themes for the new year:

Persisting volatility

Moderating inflation

Bear market bottom