Research to help you reach your financial goals.

At Fi3 Financial Advisors, we are committed to providing timely and well-researched financial and investment guidance to our clients so that they can make more empowered financial decisions. These featured resources often are used to help guide our conversations.

Private Market Semi-Annual Update

• Following two years of waning deal activity, the first half of 2024 has seen a promising rebound, with a year-over-year increase of 12%.1 Corporate carveouts and smaller add-on transactions remained particularly attractive to General Partners.

• The median fundraising timeline has stretched beyond 18 months, largely due to a shortage of distributions affecting Limited Partners’ capacity to commit to new funds.1 Nevertheless, high-conviction and appropriately sized funds continued to be oversubscribed, achieving rapid closings.

• Exit activity remained a significant challenge, with capital calls outpacing distributions for the third consecutive year. The emergence of continuation funds as a popular exit strategy reflects the industry’s adaptation to this dynamic. In addition, there has been discussion swirling at the largest end of the market as some companies may start to become ‘too big to exit’.

• There is a divergence in performance between mega funds and middle-market funds, the latter of which posted more compelling returns. This trend underscores the potential advantages of investing in the lower and middle market where funds often benefit from less leverage, greater operational agility and a broader range of exit options.

2024 Financial Planning Guide

Our 2024 Financial Planning Guide shares current information on areas including:

Tax planning.

Retirement planning.

Estate planning.

Education planning.

Risk management.

Long-term care.

2023 Review & 2024 Outlook Video

Listen to Bob Schaefer, Senior Director of Investments, talk about the review of the 2023 market and what 2024 currently looks like.

2023 Portfolio Rebalancing

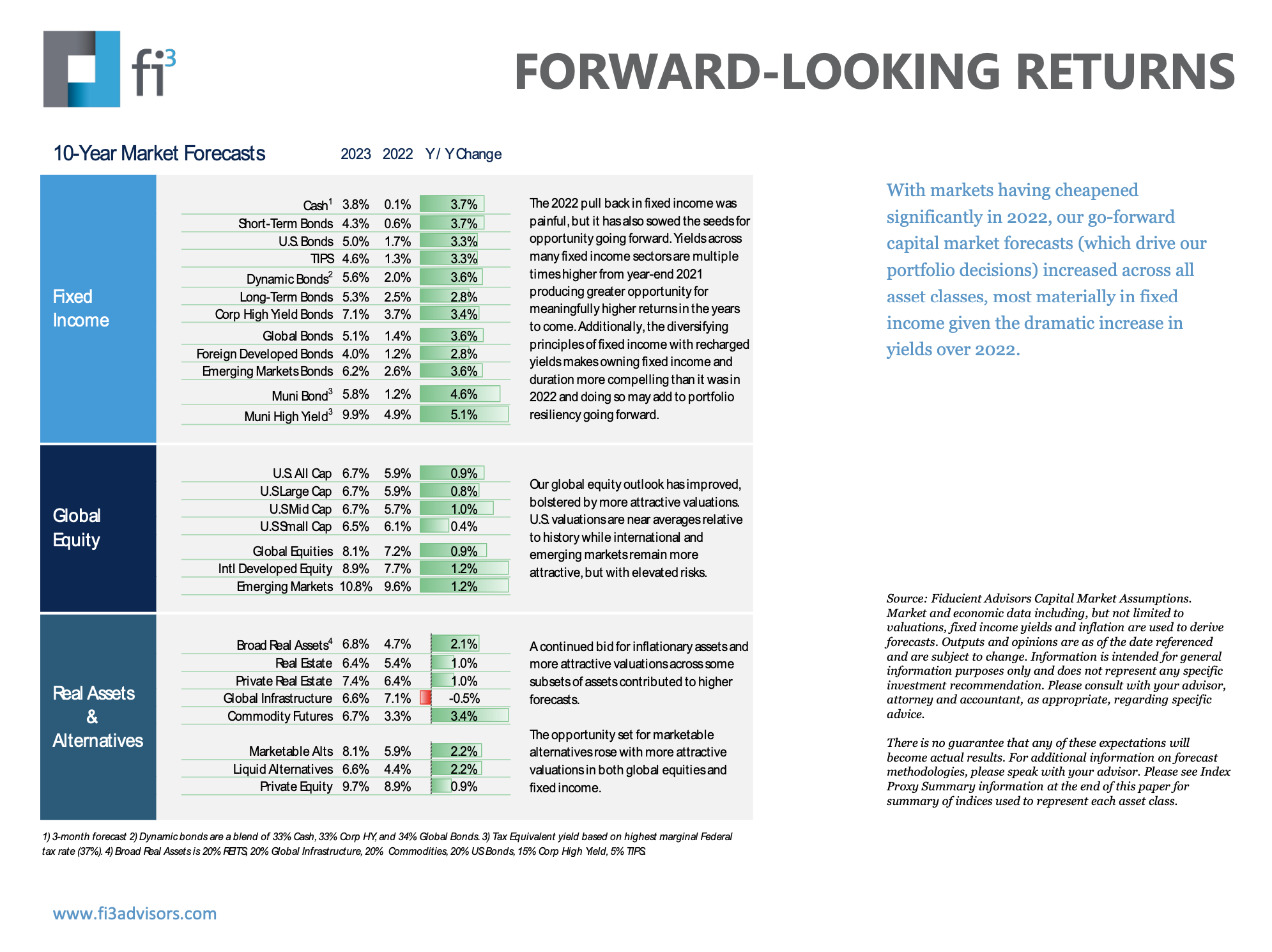

With markets having cheapened significantly in 2022, Fi3's go-forward capital market forecasts (which drive our portfolio decisions) increased across all asset classes, most materially in fixed income given the dramatic increase in yields over 2022.

2023 Financial Planning Guide

Our 2023 Financial Planning Guide shares current information on areas including:

Tax planning.

Retirement planning.

Estate planning.

Education planning.

Risk management.

Long-term care.

2023 Market Outlook

Opportunity is forecasted to grow in 2023, even with the continued uncertainty the markets have experienced in recent years. With capital marketing forecasts increasing across all asset classes (most materially in fixed income,) our outlook features three key investment themes for the new year:

Persisting volatility

Moderating inflation

Bear market bottom